You and your team have spent thousands of hours and hundreds of thousands of dollars bringing your newest product or service into existence. Would you pluck the price out of thin air?

If you think that doesn’t sound smart, you’d be right. So how do you make an informed decision on how to price your products?

The answer: competitive pricing analysis.

Don’t know what that is? Sit tight, we’re about to break it down for ya. 👏

In this article, we cover:

- How pricing analysis can help you win more market share and position your products more effectively.

- Six powerful sources of pricing data (including some you definitely haven’t thought of)!

- Why code doesn’t help in pricing analysis as much as you might think.

- Two examples of how a B2B and B2C business might perform a pricing analysis on their competitors.

What is competitive pricing analysis?

A competitive pricing analysis sees you gather the prices of your competitors’ products over time. You’ll use this data to draw comparisons and conclusions about which direction your own pricing strategy should head in. Competitive pricing analysis can alert you to shifts in market trends as far as product pricing goes, and can help you position your products more effectively.

Benefits of a competitive pricing analysis

So, that’s competitive pricing analysis in a nutshell. But what’s the point really?

Glad you asked! Truth is, there are tons of great reasons to perform a competitor pricing analysis. Here are a few:

- Stop losing profits to competitors, so you can reinvest more in your products, creating a self-reinforcing spiral of product awesomeness and brand domination. 🏋️♂️

- Optimize your pricing strategy to win more market share, ensuring no wasted expenses and maximum ROI, making you the darling of the business. 😊

- Improve understanding of buyer behavior, so you can make smarter decisions about your product’s future, and be responsible for huge surges in revenue. 📈

- Identify and get ahead of competitive pricing trends, eliminating stressful surprises, and making your workplace an ocean of calm despite all the winning. 🐳

Let’s dig into each in a bit more detail.

Avoid losing profits to competitors

Who decided on the prices of your products? And how did they do it?

They didn’t just pull a number out of thin air. When you’re pricing a product, your competitors are (naturally) the first place you look. In fact, you’re likely to look at how competitors price their products before you even get to the drawing board for that product. 🎨

That’s because you need to know how much you can charge your customers before you commit to the costs of production. If every comparable product on the market retails for 50% of what you’ll have to charge, given the production costs you’ve been quoted, your product idea’s a non-starter!

No. You need an idea of how your competitors are pricing their products so you can create a winning positioning strategy. One that includes details on how you’ll price your own products. It should go further than that, though. You want to figure out which unmet customer needs your product will meet, which of their problems it’ll solve, and the experience it’ll offer while doing so.

Positioning with pricing

If you’re offering a premium experience and meeting as-yet unmet needs, you can charge a premium. So long as your price is justified, and you communicate those justifications to your target audience in a way that makes them happy to pay a premium (wave to your wonderful marketing team!), you’ll have happy customers and a profitable product.

Ok, but how does this help you avoid losing profits to competitors?

You won’t think to double-check your messaging to make sure it communicates your product’s worth. You won’t think to wonder how your competitors can sell so cheaply, and look for creative ways to cut supply chain or manufacturing costs.

Or, if competitors are charging higher prices than you for a similar product, you won’t start asking what it is about your product that’s failing to win you more market share despite the cheaper price.

To sum up, performing a competitor pricing analysis regularly keeps you on top of changes to your competitor’s prices, so you can react swiftly with your own changes where necessary. It acts as a trigger for reflection and innovation, so you don’t lose profits to your competitors.

Optimize pricing strategy to win more market share

To make strategic decisions, you need intel. ♟️

That holds true for pricing, too. The more you know about how your competitors price their products, and why, the smarter the decisions you’ll be able to make about your own pricing. And if you want to win more market share from your competitors, you want to be making the smartest decisions you can about your prices. To do that, get your hands on as much intel as possible by doing a competitive pricing analysis.

Improve understanding of buyer behavior

Price is just one factor in why a customer does or doesn’t buy. And it’s never as simple as “cheaper is better”.

Depending on the niche, premium prices are often actually more attractive to consumers and decision-makers than cheaper prices. When risk is high, people would rather pay more to be that much more certain they’re getting a quality service than cut costs and risk having to redo the job. Would you trust the cheapest consultant’s advice right before a huge merger or acquisition deal?

That’s why it pays to look at pricing data with an open mind. Get your hands on quality data, combine it with what you already know. Specifically, what you know about how your customers buy, and you’ll be rewarded with deeper insights into buyer behavior and how to optimize for it.

Identify and get ahead of competitive pricing trends

“The best time to plant a tree was 20 years ago. The second-best time is today.” — Chinese Proverb

To identify trends, you have to collect data over time. Without quality historical data, you’ll have too few data points to be able to draw real conclusions.

That’s why it pays to start collecting data right now. Sure, it’d help if you had decades of data to pull from, but a database starts from a single data point. And even if you only have one data point from each competitor for now, that’s a lot better than pulling a price out of thin air.

When you pull competitor pricing data regularly, you’ll soon enough have a set of historical prices going back months or even years, making it clear and easy to identify trends in those price movements.

Then, when you identify a trend or a shift, you can make informed decisions about what that means for your own pricing strategy.

How to do competitive pricing analysis

Much like any other aspect of competitive analysis, a pricing analysis involves three or four distinct stages:

- As a preliminary stage, identify the competitors you’ll be looking into.

- Gather the necessary data.

- Analyze the necessary data and draw conclusions.

- Share your conclusions and work with others to convert them into an action plan.

Let’s examine those stages in detail.

1 – Identify the competitors you want to pull data on

First, figure out the shortlist of competitors you want to study. As we’ll discuss a little later on, it’s simply not practical to pull data from dozens of competitors all at once.

Instead, prioritize your competitors into a shortlist of those most relevant to your business success. While it’s not wise to ignore indirect competitors entirely, you have limited resources.

What criteria should you use for this? Maybe beating these select competitors means vastly more market share for you than winning versus any others. These would make good candidates.

Or, their products might just be the most similar to your own, so you’ve decided it’s important to know how they’re pricing those products.

That makes identifying the competitors you want to pull data on a crucial first step in competitive pricing analysis.

2 – Pull pricing data

Now it’s time to actually pull pricing data from these competitors.

Depending on the industry and sector you work in, this isn’t always as easy as it sounds. Many businesses don’t make their prices publicly available. Some don’t list pricing information on their websites at all, making it difficult to pull accurate pricing information on their products without contacting the business. And if you’re not actually interested in using their product, you’re unlikely to get very far asking for a quote.

Other challenges include the accuracy of the pricing information and how frequently you need to update it. If yours is a dynamic industry, competitors can change their prices extremely often with fluctuations in the state of their supply chains, the exchange rate, and the prices set by their manufacturers. If you need very accurate pricing data, you’ll need to sample prices more frequently in accordance in these cases.

Here are a few different ways of getting your hands on pricing data:

- Ask your customers and prospects.

- Ask reps from other departments.

- Look for resellers and/or distributors.

- Look on competitors’ websites.

- Search on public forums.

- Speak to industry contacts and experts.

Here’s a bit more detail:

(I) Ask your customers and prospects

Even if price information isn’t listed on a competitor’s website, or in any physical location, there’s nothing to stop you asking your customers and prospects about their own findings.

Few will do more in-depth market research than prospects motivated to find a good deal. So during your win/loss interviews, or any other stage of your competitive intelligence research that touches base with customers, make sure to do some digging on pricing information. You’ll soon get a sense for how much your main competitors are charging.

You can even ask whether competitors have put prices up or down recently. If the prospect or customer has recently adopted, or moved away from, one of your competitors, they might just have the answer.

(II) Ask reps from other departments

Even if your business doesn’t do a ton of customer research yet, your sales and customer success teams will still regularly hold conversations with won and lost prospects. If you can get these groups to systematically ask and log information about pricing as a part of these conversations, you’ll have access to pricing info you might not find elsewhere.

(III) Look for resellers and/or distributors

With a bit of detective work, you can usually identify a reseller. They’ll typically use similar language and messaging as your competitor, but with subtle differences in branding, like different packaging, or colors.

Some of these businesses won’t have the same qualms about listing pricing information publicly as your competitor has. If you can sample a few at a time, you’ll get a decent spread of prices that have a direct correlation to the price of your competitor’s products.

(IV) Look on competitor websites

This one’s obvious, but you shouldn’t overlook it. Not all businesses are against making their prices publicly visible. In some industries, it’s even the norm, making it very easy to access up-to-date, accurate price data.

(V) Search on public forums

Noticing a theme, here? Pricing information is collected through many of the same channels as your other competitive intelligence data. Online forums like Reddit or even LinkedIn are home to groups of people with no qualms about candidly discussing their experiences with your competitors. That includes what they paid.

(VI) Speak to industry contacts and experts

Any business leader wondering how to price their products probably has a network of contacts in their industry. There’s nothing stopping you from consulting with these people (whether as a favor between friends or as a professional contract with industry consultants) and getting hold of pricing data that way.

3 – Compare and analyze your pricing data

With pricing data in-hand, it’s time to put it to work.

The more data points you have, the easier it’ll be to identify trends, as we mentioned earlier.

But a single set of up-to-date prices for each of the competitors on your shortlist is more than enough to get started with. Combine this information with what else you know of their positioning strategies. Are they the budget option? Are they the luxury, premium option? What else about their messaging and branding gives you that impression? And where are the open gaps in the market you can position yourself to fill?

A competitive pricing analysis tends to go hand-in-hand with a competitive gap analysis or a market opportunity analysis for this reason. A comprehensive analysis of the competitive landscape and your place within it compared to your competitors can give you a clear view of where to plant yourself to capture the largest possible market share.

4 – Come up with an action plan

So, knowing what you know of your competitors’ prices, what will you do?

Does your competitive pricing strategy need to change? Will you change your own pricing? Or can it stay the same?

Can you identify any new trends in pricing behavior by combining your newest data with historical data?

It’s worth noting at this stage that it’s usually not the job of the competitive intelligence professional to devise and implement an action plan. That usually falls to leadership, or some other group of stakeholders.

What you should be prepared to do, however, is to communicate your findings while presenting a clear and defensible point of view. From there, you can work with these groups, if necessary, to chart a clear course of action in light of what you’ve found.

Is your competitive program effective enough?

Imagine if you could:

- Set up your listening stack to gather competitive intel with ruthless efficiency, giving you more time to analyze, enable, inform, and become your business’s champion. 💪

- Set up win/loss interviews to unveil the powerful reasons why customers aren’t choosing you, even if you’ve got no time or resources. 🔎

- Deliver a competitive news briefing that gets people talking, no matter which set of stakeholders you serve. 📣

We’ve got a brand new course that covers every aspect of competitive intelligence, and what it takes to be successful.

Interested? Click the button right now to check it out.

That sounds like a lot of work… why can’t you just use code to do this for you?

The majority of retailers have an online store. Online stores have pricing information. Since it’s information that’s open to the public, you’re well within your rights to log this information for your own records.

So why not just use Python’s BeautifulSoup library, or something similar, to scrape all the data you can from as many competitor websites as possible and call it a day?!

Well, web scraping actually goes against the terms of service of many websites. Many will block suspicious scrape-like activity. In some places, it’s actually illegal. 😬

What’s more, it’d be a hard task if you wanted to track pricing on a bunch of competitor websites at once. Different websites have different layouts, and are built on different code bases. Both these facts create problems for those wanting a single script to scrape the data from a list of user-defined websites, for example.

That’s why it’s best to decide, from the start, which select few competitors you want to track pricing information for.

So, while manual data entry might not be what gets you out of bed in the morning, stick by the eternal CI mandate to prioritize ruthlessly, and the job won’t take too long.

Plus, with only a shortlist of competitors to check up on, it’s easy to check their terms of service and see if web scraping is something they do allow. Depending on who those competitors are, some websites even offer an API to make extracting price data quick and easy. Amazon’s Product Advertizing API is one example.

Competitive pricing analysis examples

To really hammer these points home, we thought we’d walk you through a couple of competitive pricing analysis case studies.

Case study one: B2B workout equipment manufacturer and supplier

Who we are: We’re “Carbon Strength & Fitness,” a manufacturer and supplier of top-of-the-line workout and gym equipment. 😏

What we do: We work with distributors to get our equipment out to high-end gyms for professional athletes and dedicated amateurs.

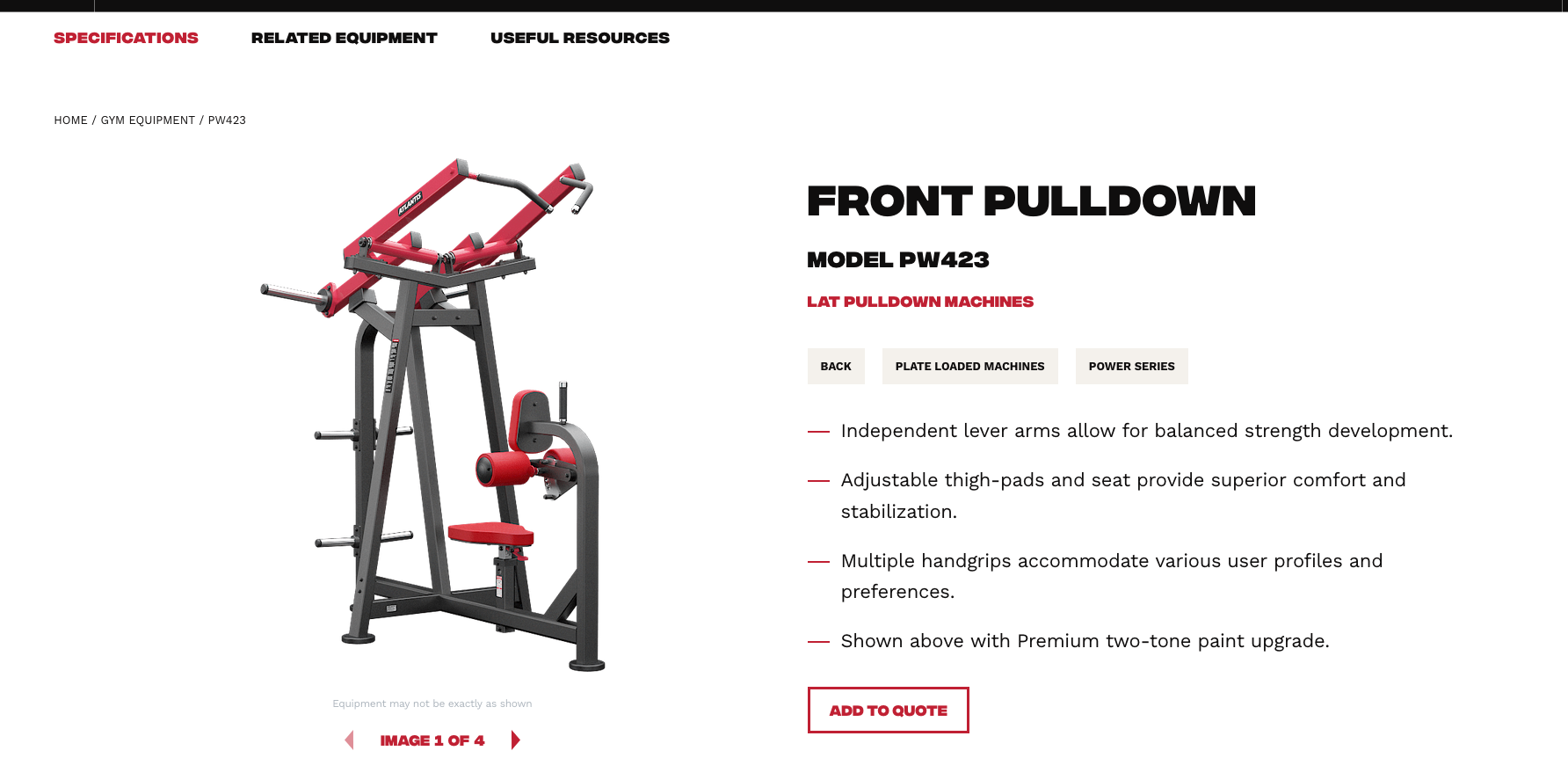

Our competitors: We consider our primary competitors to be Prime Fitness USA and Atlantis Strength. Both are based in the USA, whereas we are based in Europe, giving us a slight competitive advantage geographically when it comes to serving these regions.

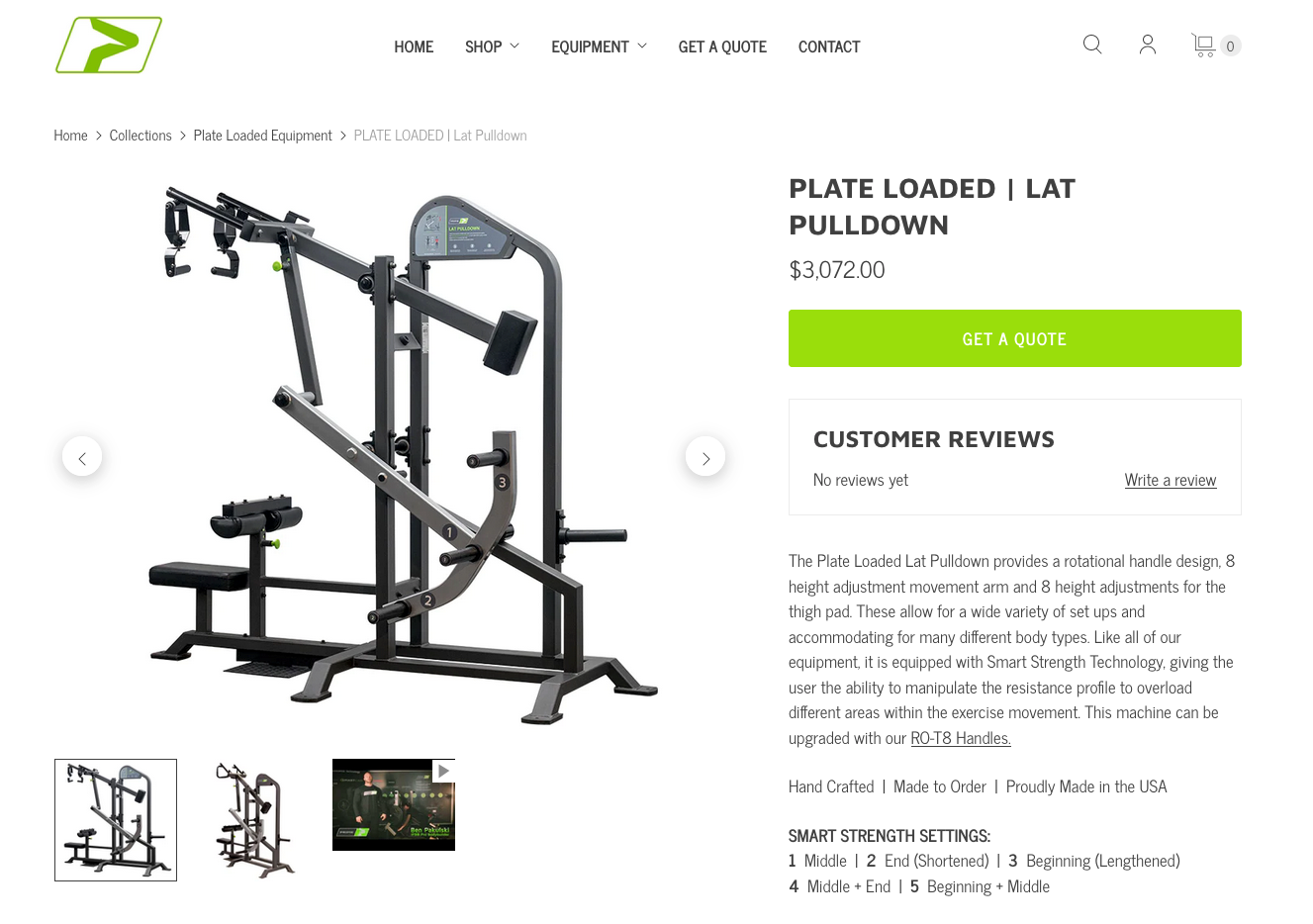

Our product: We’re launching a new plate-loaded upper back- and lat-pulldown machine, and need to know how to price it. Atlantis Strength doesn’t list a price point on its website but, luckily, Prime Fitness does. Their machine is the current market leader, rapidly growing in demand thanks to its articulating handles and multiple possible loading patterns. These empower gym-goers to alter the movement’s resistance profile and arm path.

These are design features we’ve incorporated into our own product, while using more cost-effective materials in favor of a higher maintenance frequency. Our great relationship with suppliers and patented interlocking parts make our manufacturing costs lower than Prime’s and Atlantis’s.

The pricing analysis: We predict the lower initial outlay will make us a popular option for newly launching gyms with lower budgets that still want the best for their members. For that reason, we decide to charge a premium price, while undercutting Prime Fitness’s plate loaded pull down, which is priced at $3,072.00 per unit.

We’d like to price ours somewhere between this and Atlantis’s pull down machine, which a search on Reddit revealed has been sold in good but used-condition for around $950. From speaking with our network of contacts in the industry, we know used equipment tends to hold its value pretty well, never selling for much less than 70% of its original value so long as it’s well-maintained.

Judging by the condition of the piece, plus the fact it was purchased five years ago, we’ve adjusted for inflation and estimate the original value of the piece to be around $1500.

Since our machine is mechanically superior to the Atlantis, but we want to pass savings onto our customers and make additional profits in volume of sales, we decide to price our product at a little over $2000USD.

Case study two: B2C acoustic musical instrument manufacturer

Next, a B2C manufacturer of musical instruments.

Who we are: We’re “X Drums”, and we make acoustic drum kits.

What we do: We’re looking to launch a new range of affordable mid-range drum kits for students and casual players looking to get a great sound for less.

Our competitors: Mapex and Pearl drums are our two biggest competitors in this price range. Although other classic brands, like Gretsch, sell kits in this range, they tend to be smaller four-piece kits right in the lowest price ranges they sell at.

The pricing analysis: Although Mapex and Pearl don’t list prices on their websites, it’s not difficult to find prices for their drum kits on distributor websites. We know that drum kits in these price ranges cost around $1000.

With our manufacturing costs, we know we won’t be able to turn much of a profit selling at $1000. Since we don’t see a way to position our new brand name above our established competitors, we’ll price similarly, but offer deals that up-sell our other products. These will include items like kick drum pedals and our own-brand cymbals, allowing us to turn a profit on the bonuses in these package deals.

TL;DR

By now it should be clear, from the sample case studies and everything we’ve discussed in this article, how you can get started with competitive pricing analysis.

Here’s a quick summary of what we’ve learned:

- Competitive pricing analysis has you gather your competitor’s prices over time and use this data to make data driven, strategic decisions about your own products.

- Competitive pricing analysis helps you position your products more effectively while getting and staying ahead of evolving trends.

- It can be tricky to find accurate pricing data, but if you’re resourceful, and tread the path less traveled in your search, you’ll find information you can work with.

- Programmatic pricing analyses are often unethical and often less practical than you might think (though aren’t impossible).